Little Known Facts About Clark Wealth Partners.

Wiki Article

About Clark Wealth Partners

Table of ContentsClark Wealth Partners - The FactsClark Wealth Partners Fundamentals ExplainedSome Known Incorrect Statements About Clark Wealth Partners What Does Clark Wealth Partners Do?Excitement About Clark Wealth PartnersClark Wealth Partners Things To Know Before You BuyA Biased View of Clark Wealth Partners

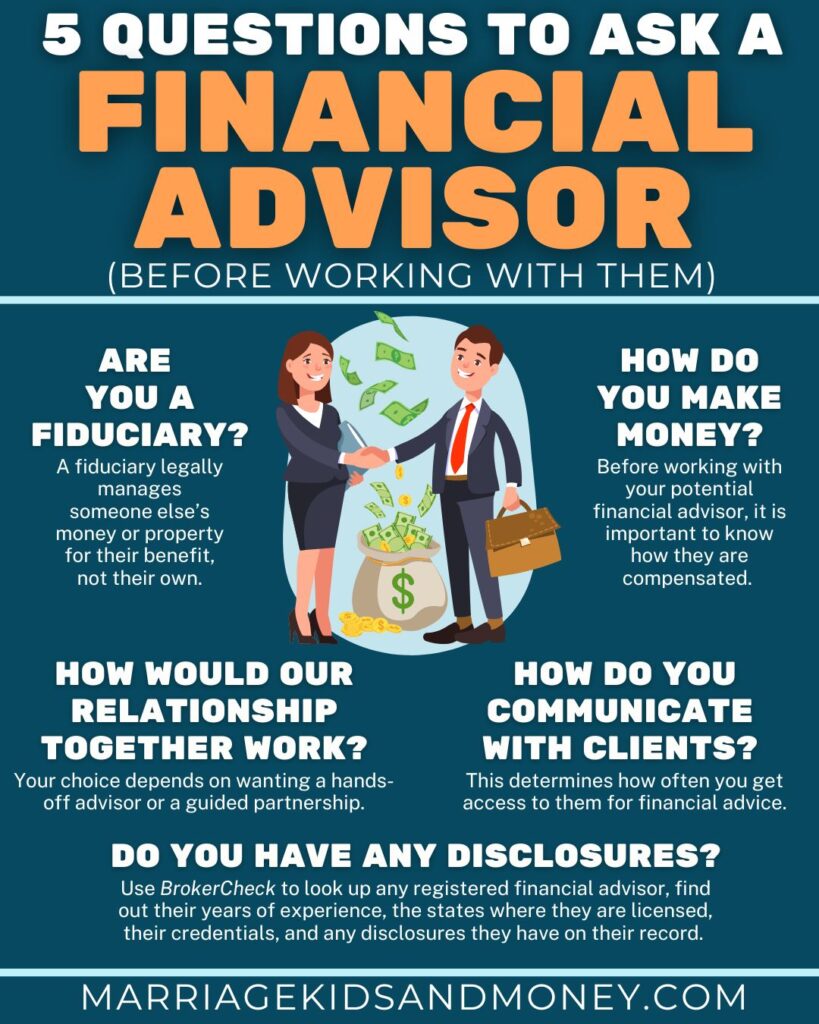

These are professionals who give investment advice and are signed up with the SEC or their state's protections regulator. NSSAs can help seniors choose regarding their Social Safety and security benefits. Financial advisors can also specialize, such as in student car loans, elderly requirements, taxes, insurance policy and various other elements of your financial resources. The certifications required for these specializeds can differ.Not constantly. Fiduciaries are lawfully needed to act in their client's benefits and to maintain their money and residential or commercial property separate from various other properties they manage. Just financial advisors whose classification requires a fiduciary dutylike qualified financial organizers, for instancecan state the very same. This distinction additionally implies that fiduciary and financial consultant charge structures differ as well.

Top Guidelines Of Clark Wealth Partners

If they are fee-only, they're more likely to be a fiduciary. Lots of credentials and designations call for a fiduciary obligation.

Choosing a fiduciary will certainly guarantee you aren't guided toward specific investments as a result of the commission they offer - financial advisors Ofallon illinois. With great deals of money on the line, you might desire an economic specialist who is lawfully bound to make use of those funds meticulously and just in your benefits. Non-fiduciaries might suggest investment items that are best for their pocketbooks and not your investing goals

Clark Wealth Partners - An Overview

Learn more currently on just how to keep your life and cost savings in balance. Boost in savings the ordinary home saw that functioned with an economic consultant for 15 years or even more compared to a comparable house without a financial expert. Resource: Claude Montmarquette & Alexandre Prud'homme, 2020. "Much more on the Value of Financial Advisors," CIRANO Job News 2020rp-04, CIRANO.

Financial recommendations can be valuable at turning points in your life. Like when you're starting a family members, being retrenched, preparing for retirement or managing an inheritance. When you satisfy with an advisor for the very first time, exercise what you desire to receive from the guidance. Before they make any type of referrals, an adviser should make the effort to review what's vital to you.

7 Easy Facts About Clark Wealth Partners Described

As soon as you've agreed to go ahead, your financial advisor will certainly prepare a financial strategy for you. You ought to always really feel comfortable with your adviser and their guidance.Urge that you are informed of all purchases, which you obtain all document associated to the account. Your advisor might recommend a handled discretionary account (MDA) as a method of handling your investments. This involves signing a contract (MDA contract) so they can buy or offer investments without needing to get in touch with you.

The 5-Second Trick For Clark Wealth Partners

Before you purchase an MDA, contrast the advantages to the prices and threats. To protect your money: Don't provide your adviser power of attorney. Never authorize a blank paper. Place a time restriction on any type of authority you give to buy and market financial investments in your place. Firmly insist all communication regarding your financial investments are sent out to you, not simply your advisor.If you're moving to a new consultant, you'll need to arrange to transfer your monetary records to them. If you require help, ask your consultant to discuss More about the author the process.

To load their footwear, the country will need more than 100,000 brand-new monetary experts to go into the industry.

The Best Guide To Clark Wealth Partners

Assisting people attain their monetary goals is a monetary expert's main feature. They are also a tiny organization owner, and a portion of their time is devoted to managing their branch office. As the leader of their technique, Edward Jones monetary consultants need the leadership skills to hire and manage staff, in addition to the business acumen to develop and execute an organization method.Financial consultants spend time everyday seeing or reading market news on television, online, or in profession publications. Financial consultants with Edward Jones have the advantage of office research teams that assist them keep up to date on stock referrals, mutual fund administration, and a lot more. Investing is not a "set it and forget it" task.

Financial advisors ought to set up time every week to satisfy new individuals and overtake the individuals in their round. The financial solutions industry is greatly regulated, and regulations alter frequently - https://canvas.instructure.com/eportfolios/4092262/home/financial-advisors-illinois-expert-guidance-for-your-financial-journey. Numerous independent economic consultants spend one to two hours a day on compliance activities. Edward Jones monetary advisors are fortunate the office does the heavy training for them.

Facts About Clark Wealth Partners Revealed

Edward Jones economic advisors are encouraged to seek additional training to broaden their understanding and skills. It's also a good concept for monetary advisors to attend sector conferences.Report this wiki page